Leo Nelissen

Investment Group

Summary

- I've never been more cautious: inflation is sticky, sentiment is gloomy, and the Fed's 2% target may no longer be realistic.

- I see a paradigm shift where higher inflation and weak growth force investors to rethink how they protect wealth and find value.

- This is the trickiest economy I've ever faced, but with the right strategy, I believe it's possible to turn challenges into opportunities.

Looking for more investing ideas like this one? Get them exclusively at iREIT®+HOYA Capital. Learn More »

The important question for the investor is not whether conditions are good or bad (if, in fact, they can be measured on such a scale), but whether they are changing for the better or for the worse relative to expectations. - Arthur Zeikel

The important question for the investor is not whether conditions are good or bad (if, in fact, they can be measured on such a scale), but whether they are changing for the better or for the worse relative to expectations. - Arthur Zeikel

Introduction

It's time to talk about the Big Picture.

Right now, I think it's fair to say that tensions are high.

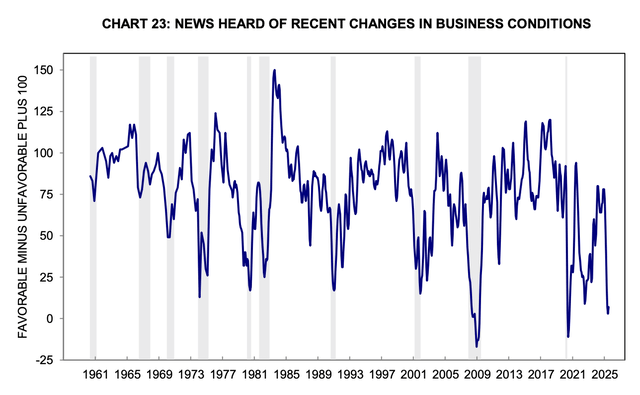

Generally, people seem to have strong opinions about both economic and political developments, which is supported by University of Michigan data, showing that sentiment from recent news headlines impacting business conditions hasn't been this bad since the pandemic, as we can see below.

University of Michigan

This is fascinating, as news-related sentiment has been worse just twice since at least the 1960s. During the pandemic, we were dealing with a wave of global lockdowns, while most people had no idea how bad COVID could get.

During the Great Financial Crisis, the economy took a monster hit due to imploding banks, which had a ripple effect through almost every single sector.

Now, things are different.

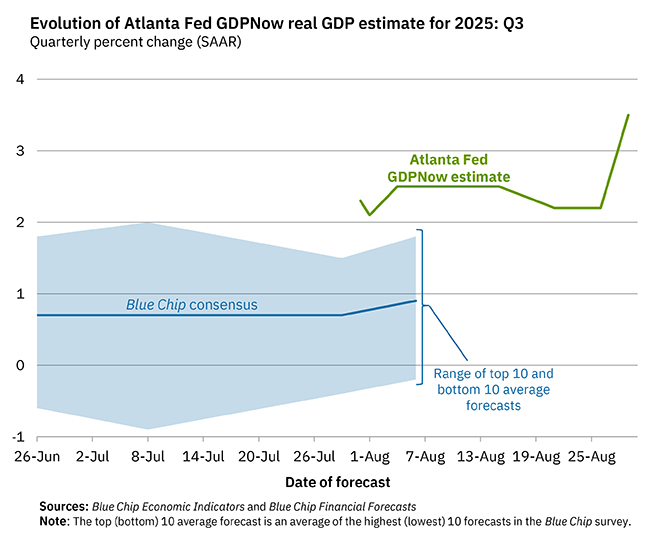

There's no pandemic, no bank failures, no major natural disasters, and a rosy GDP growth outlook, as the Atlanta Fed sees roughly 3.5% annualized growth.

Federal Reserve Bank of Atlanta

So, why is everyone so depressed?

In this article, I'll tell you why that is and what this could mean for our money, as I expect one of the biggest rotations in decades.

As we have a lot to discuss, let's get right to it!

Inflation, It's Becoming An Issue

Generally speaking, things aren't that bad. We just saw the GDP outlook of the Atlanta Fed, and we established the obvious facts that the economy isn't suffering from a pandemic, a systemic banking crisis, or natural disasters.

Moreover, the Misery Index, which shows the combined rates of inflation and unemployment, is at just 7.0%, a number that's far from bad and off its highs.Data by YCharts

So, what's the issue?

The issue is that investing and sentiment aren't about the current environment but what could be in the future. It's human nature to always think about what could be next. It also explains why so many people are already in a bad mood when on vacation, as they are already thinking about going back to work.

Right now, there are many things to be worried about.

For starters, the biggest issue is inflation. Ever since the end of the pandemic lockdowns, I have discussed the possibilities of a "higher for longer" pricing and interest rate environment. Unfortunately, this has turned into reality.

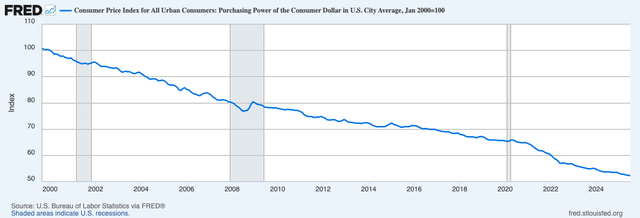

I'm saying "unfortunately" because, as much as I love to be right about stuff, high inflation is not something I want to see. For example, the purchasing power of a $100 bill in 2000 has now fallen to just $52, as we see below.

Purchasing Power of the Consumer Dollar in U.S. City Average (Federal Reserve Bank of St. Louis)

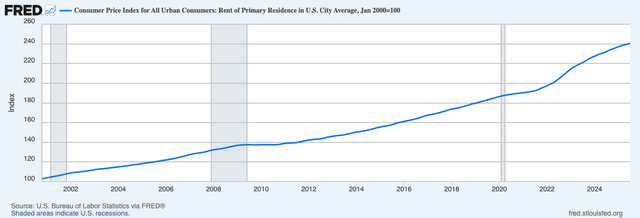

Personally, I believe the loss of purchasing power is worse for many people, as primary rent inflation alone has been +140% since January 2000. While many own their primary residence, an ever-increasing number of people are being priced out of the market, which makes them even more prone to inflation, as they are subject to higher prices and often lack the assets for protection.

Consumer Price Index for All Urban Consumers: Rent of Primary Residence in U.S. City Average (Federal Reserve Bank of St. Louis)

That's one of the reasons why inflation worries me.

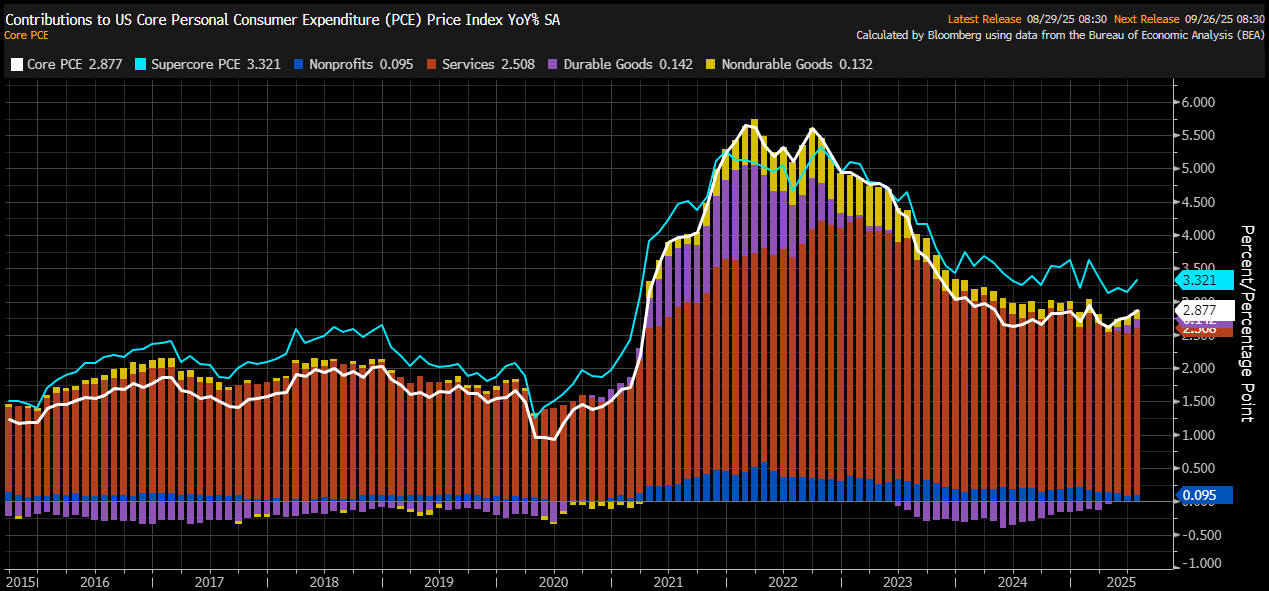

Recent PCE numbers confirm my concerns. The Personal Consumption Expenditures price index, which is its full name, is similar to the CPI but includes third-party household spending, such as health insurance and government programs, as well. It aims to provide a clearer picture of all costs faced by households, which are the obvious backbone of the U.S. economy.

Last week's release showed a 2.6% annual rate, which means the Fed's favorite inflation number is 60 basis points above its target. To make matters worse, it's trending up, which is the last thing the Fed wants to see right now.

Moreover, as the chart below shows, supercore inflation, which excludes volatile items like food, energy, and even housing, was 3.3%.

X/@M_McDonough

To use the words of Mohamed A. El-Erian, "[...] there is a concern that the disinflationary effect of the goods sector is unlikely to persist, which may push the core inflation rate above 3%."

In simpler terms, he's saying that the tailwinds from lower goods inflation since the pandemic are not lasting. It's a point I have made in the past as well, as we need to be aware that inflation has been bottoming despite a substantial decline in oil and gas prices, two of the biggest drivers of inflation.

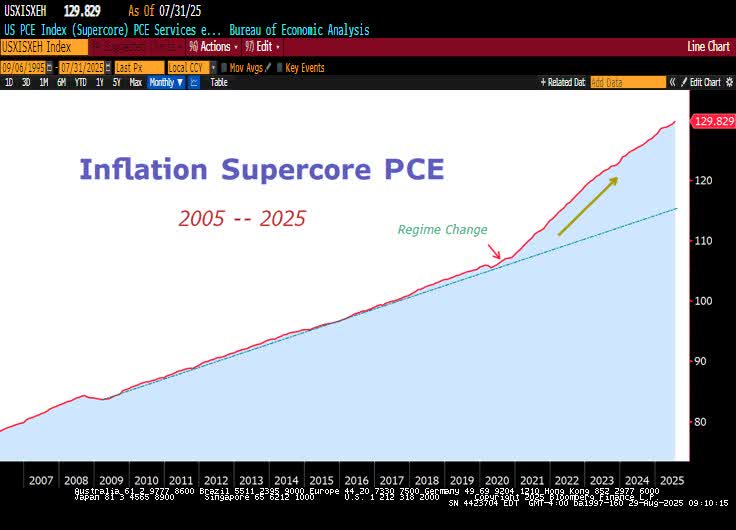

Essentially, what we are dealing with here is what Lawrence McDonald calls a "regime change." Like me, he has made the case for "higher for longer" rates for quite some time, noting that "the lost world" is an inflation environment that ended shortly after the pandemic's first wave of lockdowns (see below).

Bloomberg (X/@Covertbond)

He also clearly noted at what point supercore PCE started to divert from its long-term uptrend, which was at the end of 2020, the start of the "higher for longer" environment that I have brought up so much that it's almost starting to annoy me, to be completely honest with you.

Bloomberg (X/@Covertbond)

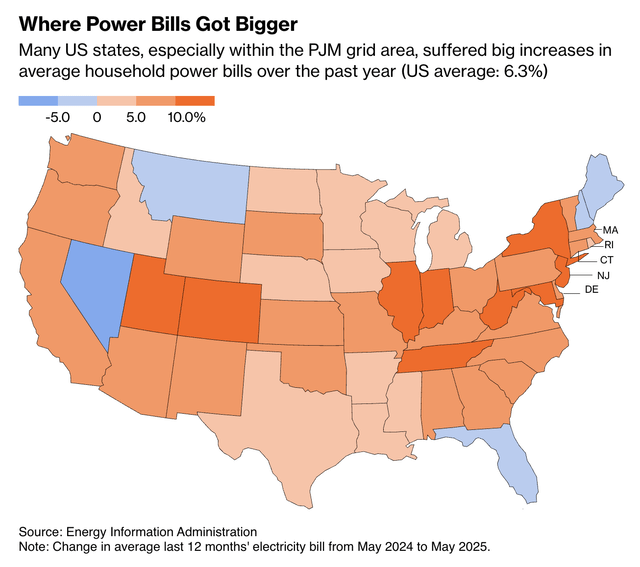

Now, we can assume that higher inflation has legs for a number of reasons, including the two energy-related factors below:Energy prices seem to be bottoming, supported by increasingly favorable fundamentals.

The AI revolution has massively fueled power demand, causing electricity bills to rise by double digits in many areas (housing-related inflation).

Bloomberg

However, the biggest factor could be tied to the government.The Fed's 2% Target May Be At Risk

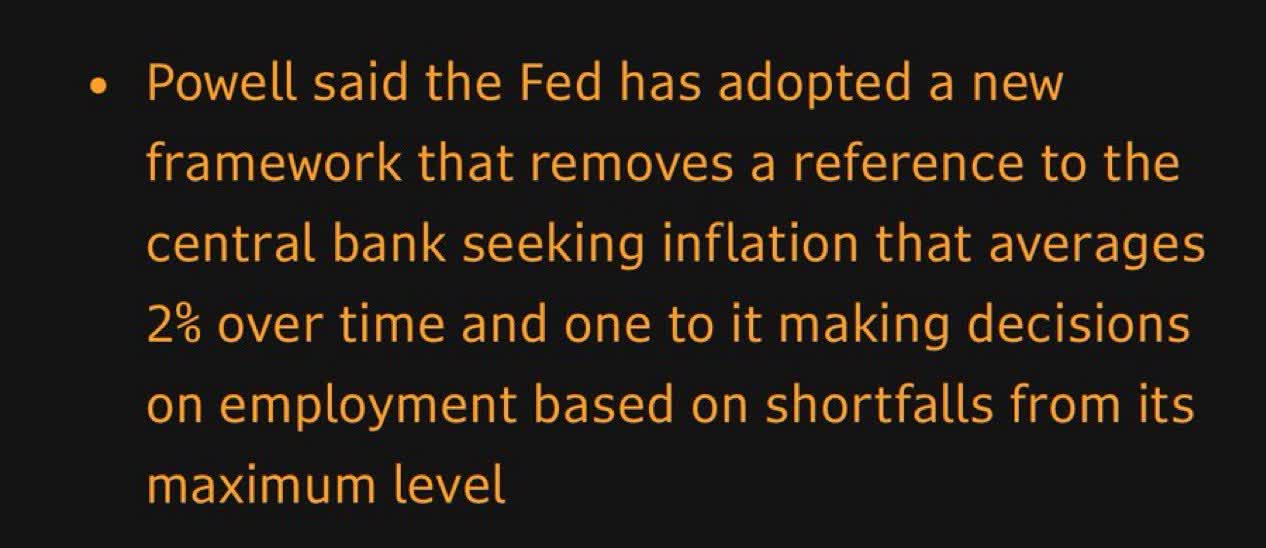

If there's one thing I have often discussed with my "inner circle" since 2021, it's that the Fed has abandoned its 2% target. Needless to say, the Fed hasn't officially made the case, as I believe the side effects of such a statement could be severe.

Instead, we have seen increasing evidence that something has changed at the Fed, including a framework adjustment, as I discussed in a recent article titled "The One Call That Could Define My Portfolio For The Next Decade."

Back then, I brought up the Jackson Hole meeting, where the Fed mentioned that it is seeking an average inflation rate of 2%, which means it can let it run hot in case it needs to prioritize economic stability (employment) over its fight against inflation.

Bloomberg

This aligns with signs we have gotten from the Trump administration, as the sitting president has been very vocal about his goal to get the Fed to lower rates, even calling Chairman Powell "Too Late."

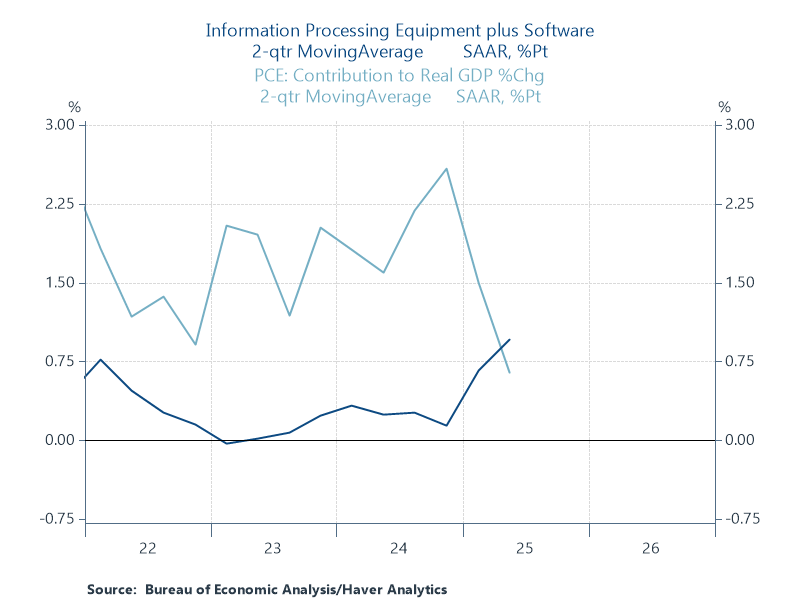

Essentially, I believe the administration is looking to run the economy hot, which my friend Albert Marko made clear in a recent article as well. I used the quote below in my "The One Call [...]" article as well:[...] the Trump administration appears to be embracing that reality with a high-stakes gamble, as it is likely to target (or accept) 4% inflation and high single-digit nominal GDP growth.These comments make sense, as the economy isn't doing too well. See, while GDP growth itself isn't in bad shape, most of it is driven by AI spending. As we can see below, consumer spending, which has weakened substantially, now accounts for a smaller part of GDP growth than AI-related spending.

While I may sound a bit dramatic, I believe this is a full-blown paradigm shift, one that could—and likely will—renew markets for years.

For investors, this means adapting to a world where cyclical stocks, hard assets, and value will likely outperform growth. - Albert Marko

Renaissance Macro Research

Strong AI spending isn't a problem. The problem is that economic growth isn't widespread. This is one of the reasons why Americans are downbeat.

For example, existing home sales have imploded, as the mix of high rates and elevated prices has "crushed" affordability for most Americans.Data by YCharts

Meanwhile, manufacturing has been in a downtrend since 2021.Data by YCharts

And to make matters worse, employment numbers are weakening, further pressured by uncertainty regarding the impact of AI on job demand.

Continuing jobless claims, for example, have gained upside momentum.

Bloomberg (X/@lisaabramowicz1)

These developments are worrying, but not the end of the world.

After all, if we get an environment where higher inflation is tolerated to boost economic growth, it may work out for the administration.

So far, we're seeing green shoots.

- Deregulation from the One Big Beautiful Bill is already positively impacting small business sentiment.

- Lower rates could fuel housing demand and real estate investments. It would also increase prices, which means employment needs to be supported as well.

- Lingering tariff risks could kickstart global trade.

This is what small business optimism looks like:

Wells Fargo

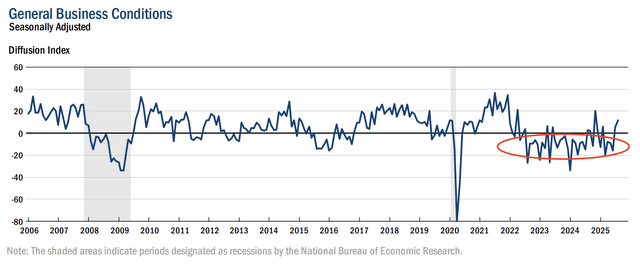

Meanwhile, manufacturing could be expanding, as major indicators like the New York Fed manufacturing index are recovering after being depressed since 2022. This would be a fantastic sign for cyclical value stocks.

Federal Reserve Bank of New York

So, what does this mean going forward?Now What?

The market is waking up to "my" thesis.

For example, while tech stocks have been the place to be for more than a decade, industrial stocks, as represented by the Industrial Select Sector ETF (XLI), have not underperformed the tech-heavy ETF (NASDAQ:QQQ) since early 2000, as the XLI/QQQ ratio has been flat-ish for roughly five years.Data by YCharts

I am very bullish on industrial stocks, including infrastructure. Many of these companies benefit from AI, including data center suppliers, grid hardware suppliers, general engineering firms, and companies like Class I railroads that benefit from pricing power and a potential recovery in cyclical demand.

That's why I have brought up Union Pacific (UNP) and Canadian Pacific Kansas City (CP) in countless articles (at least, it feels that way).

If my "cyclical value" thesis is correct, I expect a violent breakout.Data by YCharts

Essentially, it's a broadening economic growth thesis with a strong trickle-down effect from AI that should benefit industrials, materials, and even beaten-down mid/small-cap stocks.

Even energy stocks are attempting to bottom relative to the S&P 500, as we can see below. Since the end of 2022, energy has been a pain in the [you know where].

I expect this to end, which is why I have been an aggressive buyer of energy stocks with inflation protection, including Texas Pacific Land (TPL), LandBridge (LB), which are both ultra-high margin landowners, and upstream gems like Canadian Natural Resources (CNQ), which sports a yield of more than 5.0% with elevated, double-digit free cash flow potential at >$80 WTI.Data by YCharts

Needless to say, these are just examples.

There are many other companies that benefit if my thesis is correct, which is why I will spend a lot more time on finding actionable ideas.

For now, my takeaway is that I am extremely nervous, as the economic environment hasn't been this tricky in decades, if we assume we simply overreacted during the 2020/2021 pandemic.

Inflation has been an issue nonstop since 2021 despite the decline in the year-over-year growth rate of prices. To make matters worse, the Trump administration is now almost "forced" to pick protecting the economy over fighting inflation, as cyclical economic growth is poor, employment is weakening, and elevated government debt/deficits could be inflated away.

That's why it is essential to own the right assets. While general investments in index ETFs are always a good long-term solution, I believe buying additional exposure in cyclical value areas with inflation protection could be a smart move.

In this case, I'm not talking high-risk cyclicals. I am buying wide-moat businesses with pricing power and the ability to consistently increase shareholder value.

While my strategy may seem risky, I think it perfectly fits the trickiest economic environment I have ever encountered, which could produce a rotation that most are overlooking right now.

I think it's a great opportunity to pave the road for long-term alpha.Risks To Keep In Mind

As I often say, I don't run an event-driven portfolio. If anything, I make minor adjustments and invest in companies that are very resilient, even if they sometimes struggle during bear markets and manufacturing recessions.

If I am wrong, we could encounter a prolonged economic downturn, which would be "bad" for industrial stocks and energy investments. The worst case could be stagflation, which could result from ignoring inflation and failing to kickstart growth.

No comments:

Post a Comment